Even the most bullish Wall Street analysts were taken aback by Nvidia Corp.’s projection for rising sales, which propelled the chipmaker to the brink of a $1 trillion market worth and sparked a global surge in stocks related to artificial intelligence.

The Santa Clara, California-based business increased as much as 29% in extended US trading, on track to set a new high, after announcing that it anticipates sales of approximately $11 billion for the three months ending in July. With this increase, Nvidia is now on pace to post the largest one-day valuation increase in US corporate history.

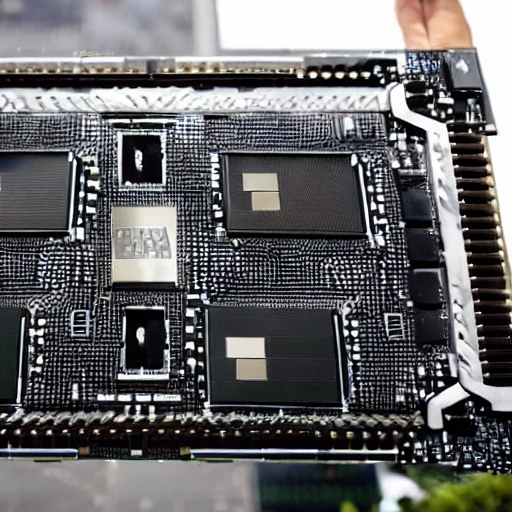

Nvidia raised already high expectations for a developing technology. Nvidia is the largest manufacturer of the cutting-edge chips used for training a new generation of AI services. Competitor chipmaker Advanced Micro Devices Inc. increased 10%, and so did its suppliers, including Taiwan Semiconductor Manufacturing Co. and Advantest Corp. In the first hours of trade in Europe, ASML Holding NV, which provides TSMC with equipment, made more than $6 billion. In a market that was mostly focused on worries about the US debt ceiling and China’s slowing economy, they added jointly more than $260 billion in value together with memory chip manufacturer SK Hynix Inc.

This year, investors increased their bets on the idea that the ChatGPT and other bots from OpenAI, which have gone viral, will mark the beginning of a new phase in the development of AI technology. The parallel processing prowess of Nvidia’s GPUs makes them ideal for data-bombarding software training.

According to Adam Crisafulli, the creator of the newsletter Vital Knowledge, Nvidia issued blow-out guidance, reiterating the bull premise that this business is at the centre of one of technology’s key transitional points.

The market’s exuberance helped to underscore the enormous anticipation surrounding the arrival of next-generation AI, which executives around the world have variously compared to the rise of the internet and the iPhone. After ChatGPT went viral in November, there has been a race around the world to create comparable systems that can generate content — everything from algorithms and photos to poems — with a few user instructions.

Although it’s yet unclear which AI service will ultimately prevail, many investors are placing bets at least that the companies that provide crucial parts for AI development and hosting would benefit from the research and spending boom.

In Taipei, TSMC, which makes the chips for Nvidia, increased by as much as 3.8%. Advantest, a supplier of equipment, rose up to 20% to a record high in Tokyo, and Hynix rose up to 6.8% in Seoul.

Jensen Huang, the company’s chief executive officer and co-founder, has established it as the leading supplier of parts for developing artificial intelligence software. This has enabled it to withstand a general slowdown in technology spending.

Investors were looking to Nvidia for proof that this year’s spike in interest in AI is having an impact on increasing sales of the chips that underpin the technology. The semiconductor manufacturer met that promise with a current-quarter revenue forecast that was vastly higher than the typical analyst projection.

According to Morgan Stanley analyst Joseph Moore, the revolutionary rise in AI spending is beginning to pay off considerably sooner than anticipated. For the size of this step function, there is simply no historical parallel.

The usage of the technology, according to Huang from Nvidia, is still in its infancy, and more specialized products for particular industries are required. To promote the widespread adoption of AI outside of his major clients, cloud service providers like Microsoft Corp. and Amazon.com Inc.’s AWS, he has created internet services and software tools.

The A100 and H100 AI chips from NVDA are receiving “truly spectacular orders,” according to Amir Anvarzadeh, a strategist with Asymmetric Advisors Ltd. in Singapore. More significantly for Asian market investors, they emphasize that TSMC is receiving all orders and has “more than adequate” capability to fulfil them.